Trust Bank Singapore, New Digital Bank Freebies!

Have you read the Short Term Update (STU) from Elliott Wave International issued on August 14, 2009?

One blogger posted what he read in the STU:

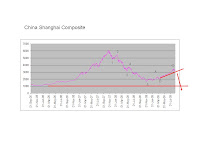

“Shanghai Composite is approaching the lower trendline. If it breaks, the odds are high the Bear Market Rally is over! And it will be the first to roll over! US indexes should follow after the reality sets in that the Chinese recovery was a mirage driven by debt, the Final Bubble so to speak.”

“Right now the S&P hovers above the crucial 992 level. A break of that indicates a change of trend, with a week-long decline before the Final Surge. Thus the perspective remains of a higher high in the range of SP1100 and Dow 10K (+/- 300) by end of summer after the decline. Dow 9700, the heart of the prior wave 4 is a common stopping point and Dow 10334 is at 50% retracement.”

“Monday should be a Chinese Curse Day for both the Chinese markets as well as US equities.”

According to one astro expert, Shanghai Composite Index had broken the Double Top neckline (low created on July 29, 2009) and 50 DMA, so expect more downside. It has strong trendline support at 2985.

So, will China's Shanghai Composite Index, the Leader in Stock Market Recovery, become the Leader in the coming Stock Market Crash? Will it become a Worldwide Stock Market Crash soon?

What does my Crystal Ball Say?

Fengshui Forecast – a possibility! Financial Astrology Forecast – a possibility! Technical Analysis – still somewhat bullish vs bearish views, but waiting for Hindenburg Omens!

When we get the Hindenburg Omens, then likely the final leg or Phase 3 of Bear Market will kick off the next leg of the Voyage to the bottom of the C!

Comments